WORK PERMIT

Establishing Companies

Companies formation in Turkey

Establishing company legal basis

Why Do You Have To Set Up A Company In Turkey?

Establishing a company in Turkey, which is located in a strategic position in the World trade, is very advantageous for foreigners . You can establish a joint stock company or limited company and can carry out any kinds of commercial activities, you can even transfer your earnings abroad.

You can get a residence and work permit for you and your family by establishing a company in Turkey, if you wish, you can enable your children to receive education in Turkey. If you have residence permit in Turkey, you can come to Turkey easily without any visa problems and stay in Turkey as long as you wish.

You can also apply for visas to foreign representatives of European and American countries and you can get a visa.

Besides all these, if foreigners who have work permits can also get citizenship for Turkey after 5 years of stay.

Prior to entry into force of Law no 4875, foreign investors seeking to establish business in Turkey were subjected to Law no 6224 on the Encouragement of Foreign Capital. In accordance with the old legislation which is outlawed by the Law no 4875, Foreign companies were subjected to a series of strict opening procedures. Among all the most controversial ones were the requirement of preliminary permission from Ministry of Treasury and a minimum 50.000 USD capital requirement per foreign partner. Moreover Law no 4875 also abolished the limitation before the commercial activities of foreign investors. Previously, foreign investors were allowed to form Joint Stock Companies, Limited Liability Companies and Branch Offices. By the virtue of Law no 4875 and most importantly by the reforms put forward by the new Turkish Commercial Code, regardless of having a legal entity, foreign investors might form all types of companies and engage commercial activities in Turkey.

Business life in Turkey was further amended by the introduction of the new Turkish Commercial Code No. 6102, which has replaced and outlawed the 55 years old Turkish Commercial Code on 1 July 2012.[2] In line with the European Union harmonization efforts the new commercial code created a well structured and less complicated business life. Moreover it reflected major EU principles such as free movement of capital.

Among all, one of the major developments achieved by the introduction of the new code is the amendment of the shareholder structure of companies. Accordingly the new law permits the establishment of joint stock companies or limited companies with a single shareholder. Furthermore, foreign individuals may form a joint stock company or a limited company. In the joint stock companies, the board of directors can be formed only by one person and the board may also meet in an electronic environment. Moreover legal entities may be appointed as board members. Thus foreign individuals or legal entities can form a joint stock company and board members might consist of foreign nationals.[3]

Required documents for establishing a company in Turkey

As in establishment of any company, basically the company’s trade name, scope of the field of activity, headquarters, director/representative, capital and shares must be determined. It is required to open a bank account based on the Potential Tax ID and deposit 1/4 (25%) of the New Partnership Capital (depending on the type and capital amount of the company) in this account. It is also required that notarized copies of the company documents are registered in the central registry system and an application is made to the related trade registry office together with the following documents:

Chamber of Commerce registration application, Chamber of Commerce registration application sample

Founding statement form, Founding statement form sample

Articles of Association certified by Notary Public, Articles of association sample

If the foreign partner is a real person; notarized translation of passport and potential tax number, Sample Passport

If the foreign partner is a legal entity; notarized translation of the certificate of activity and registry certificate issued by the chamber of industry or commerce in which the company is registered or by authorized courts which is apostilled or certified by the Turkish Consulate,

Notarized and translated Power of attorney given to the real person who will carry out the founding procedures,

Statement of the signatures of the company officials under the company titles which is certified by the notary (registration request),

Stamped and signed bank receipts if collected, Bank receipt sample

Stamped and signed bank receipt showing that the four per ten thousand of the capital is deposited in the account of Competition Authority, Bank receipt sample

Chamber of Commerce registry statement

As you can see at this point, since the original documents to be submitted for real persons who are citizens of foreign countries and legal entities resident in such countries would be drawn up abroad, these documents must be apostilled and translations thereof must be certified by the consulate or notary public. Potential tax number must be taken from the tax office for company partners who are not Turkish citizen.

After completing these transactions, the company will have legal entity following the registration by the trade registry office. Then, transactions may be carried out such as drawing up a statement of signature for the director or representative, certification of books, obtaining tax certificate. In addition, Trade Registry Offices send a copy of the “Company or Branch Founding Statement”, a copy of any modifications in the articles of association which are subject to company registration and announcement and a copy of the submitted “Partners List” or “Attendance Sheet” to the Ministry of Economy.

In addition, the companies with foreign capital are obliged to notify to General Directorate of Incentive Practices and Foreign Capital the information in relation to their capitals and activities within the framework of “Activity Information Form for Direct Foreign Investments” on annual basis and until the end of May each year; information regarding payments to capital account within the framework of “Capital Information Form for Direct Foreign Investments” within 1 month following the payments and the information regarding the transfer of shares by current local and foreign partners among themselves or any local or foreign investment outside the company within the framework of “Transfer of Share Information Form for Direct Foreign Investments” and within maximum 1 month following the transfer of shares.

Required documents for establishing a company in Turkey

The following types of Joint Stock Companies are subjected to prior permission of Ministry before their establishment and/or the amendment of their articles of incorporation.

Banks,

Financial leasing companies,

Factoring companies,

Consumer finance and card services companies,

Asset management companies,

Insurance companies,

Joint-stock company established in the form of holdings,

Companies operating currency exchange office,

Companies dealing with public warehousing,

Companies dealing with licensed warehousing of agricultural products,

Commodity exchange companies,

Independent audit companies,

Surveillance companies,

Technology development zone administrator companies,

Companies founding and operating Free Trade Zone.

Types of Companies & Required Documents

As per article 124 of the new commercial code incorporated companies are listed as Collective Company, Commandite Company, Joints Stock Company, Limited Company and Cooperative. In accordance with the second paragraph of the Article 124, Commandite (Limited Partnership) and Collective companies are classified as partnerships and the Joint Stock Companies, Limited Liability Companies and Limited partnership by shares are classified as Capital Companies.

Companies formation in Turkey

Table 2: LIMITED COMPANY – REQUIRED DOCUMENTS

Joint Stock Company (J.S.C)

Table 3: JOINT STOCK COMPANY – REQUIRED DOCUMENTS

Commandite & Collective Company

Article 304 of Turkish Commercial Code defines Commandite Companies. Accordingly Commandite Company is a form of company established for commercial purposes under a trade name. The liability of some shareholders is limited to the subscribed capital (Commanditer), on the other hand for some shareholders have unlimited liability (Commandite). No minimum capital is required for the formation of a commandite company.

As per article 211 of Turkish Commercial Code (General Partnership) can be founded by real persons for commercial purposes under a trade name. In the collective company, shareholders have unlimited liability.

Table 4: COMMANDITE & COLLECTIVE COMPANY – REQUIRED DOCUMENTS

Commandite & Collective Company

Article 304 of Turkish Commercial Code defines Commandite Companies. Accordingly Commandite Company is a form of company established for commercial purposes under a trade name. The liability of some shareholders is limited to the subscribed capital (Commanditer), on the other hand for some shareholders have unlimited liability (Commandite). No minimum capital is required for the formation of a commandite company.

As per article 211 of Turkish Commercial Code (General Partnership) can be founded by real persons for commercial purposes under a trade name. In the collective company, shareholders have unlimited liability.

Table 4: COMMANDITE & COLLECTIVE COMPANY – REQUIRED DOCUMENTS

Annexes – Sample Documents

ANNEX I SAMPLE CERTIFICATE OF ACTIVITY

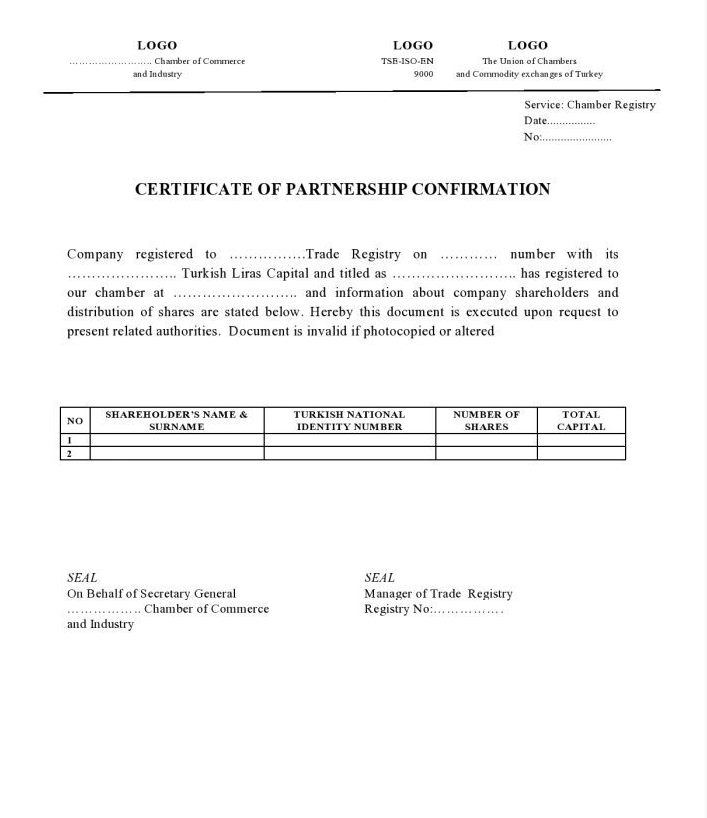

ANNEX II SAMPLE CERTIFICATE OF PARTNERSHIP CONFIRMATION

ANNEX III SAMPLE CERTIFICATE OF CHAMBER REGISTRY

ANNEX IV SAMPLE SIGNATURE CIRCULAR

ANNEX V TAX CERTIFICATE